Share

June 23, 2021Mortgage Financing, FHA Programs, Veterans AffairsBy: Scholastica (Gay) Cororaton

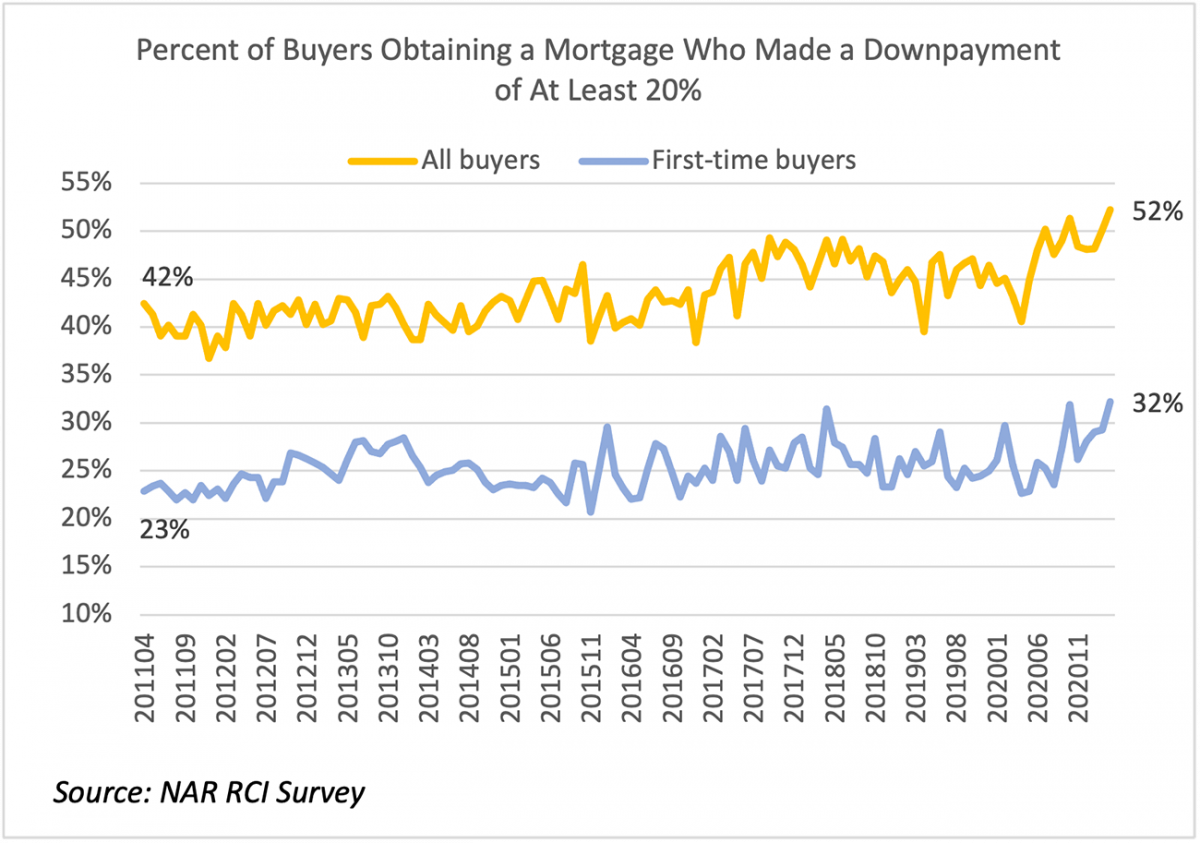

Homebuyers who make a 20% down payment and waive appraisal and inspection contingencies are on the rise, based on the May 2021 REALTORS® Confidence Index (RCI) Survey which reports monthly transactions from a random sample of REALTORS®1.

Among all buyers2 who obtained a mortgage in May, the share of mortgages associated with at least a 20% down payment rose to 52% in May 2021, up from around 40% in 2011. Among first-time buyers, nearly one in three made a down payment of at least 20%, up from around 25% in 2011. This trend reflects the decline in the share of buyers who obtain mortgages insured by the Federal Housing Administration (FHA) and the Veterans Administration (VA) which insure zero and low downpayment loans.

Buyers With Conventional Financing Edge Out Potential Buyers Obtaining FHA and VA Loans

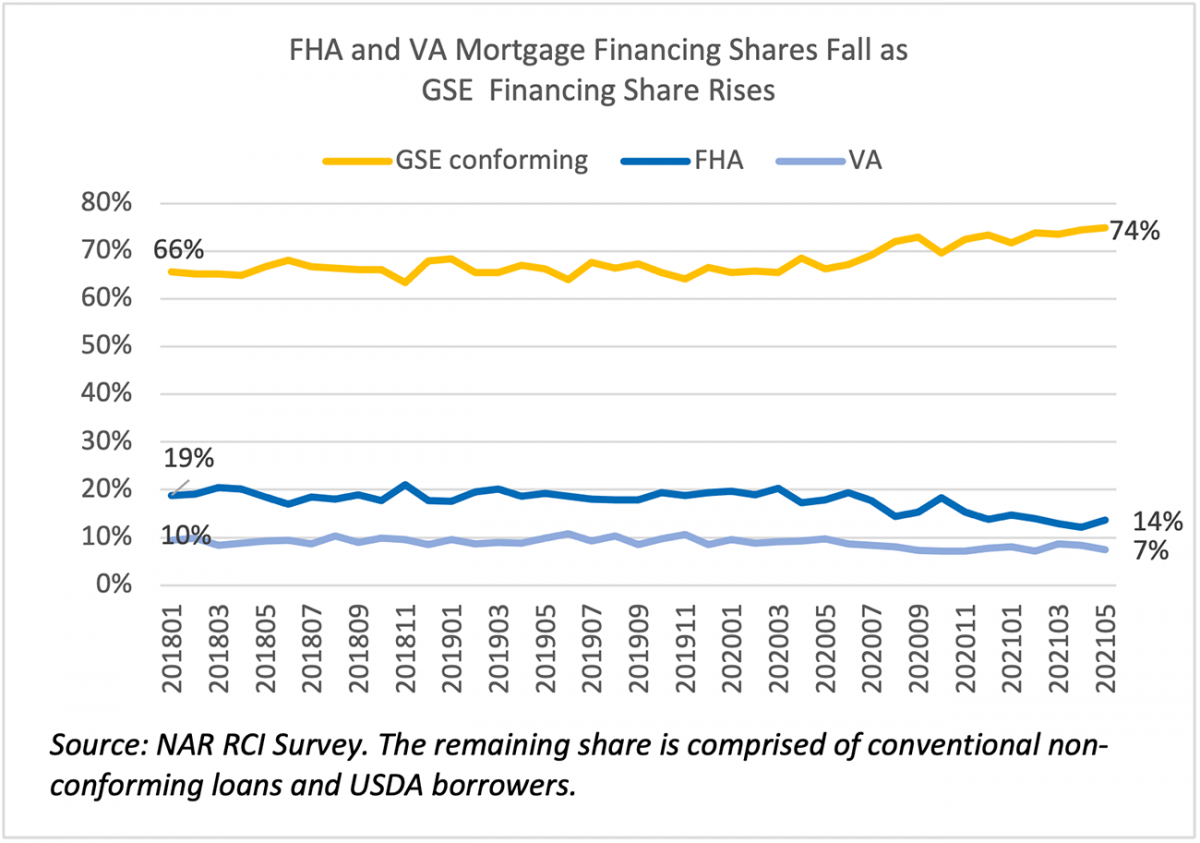

According to information provided by REALTORS®, conventional conforming mortgages (mortgages that conform to guidelines set by Fannie Mae and Freddie Mac), accounted for 74% of mortgages obtained by homebuyers in May 2021, an increase from about 65% during 2018 through 2019. Meanwhile, the share of FHA-insured mortgages to total mortgages in fell to 14% in May 2021 from about 20% in past years. The share of VA-guaranteed loans has also decreased to 7% in May 2021 from about 10% in past years.

Highly Competitive Market Is Resulting in Appraisal and Inspection Waivers on Contract Contingencies

According to REALTORS®, sellers are wary of the appraisal and inspection process. REALTORS® have reported that buyers who make an offer using FHA or VA financing find it hard to compete against other buyers who are offering cash or using conventional financing.

“It is extremely difficult for FHA/VA buyers to get accepted in a multiple offer situation. They are on the bottom of the hierarchy”

“Buyers using VA Loans are being discriminated due to ‘known low appraisals with VA loans’ which is not right at all.”

“VA Loans are at a complete disadvantage — sellers need to be offered an incentive to give more consideration to a VA Loan offer. There are a lot of misconceptions regarding VA appraisals and VA loans.”

Appraisals present a hurdle for homebuyers with VA and FHA financing at a time when prices are rising fast and homes are selling swiftly with little inventory on the market. In May 2021, the total inventory of homes (unsold) on the market was equivalent to 2.5 months of the monthly sales pace, well below the ideal level of 6 months. Appraisals, which are based on comparable sales and/or automated valuation, will always lag behind the “real-time” price based on current demand-supply fundamentals. In May 2021, the median existing-home sales price rose at a record high of 24% year-over-year, the highest annual pace since 19693. VA appraisals take anywhere from 5 to 15 days4, but properties are typically on the market for 17 days.

Homebuyers are waiving appraisals in order to close the transaction quickly. REALTORS® reported that among contract contingencies waived by the buyers, the most common contingency that buyers waived was the appraisal contingency (28%) followed by the inspection contingency (25%).

Homebuyers who are able to waive contract contingencies are those who pay cash or use conventional financing. In contrast, FHA and VA buyers are not able to waive the appraisal or inspection contract contingencies according to FHA and VA guidelines. The home inspection assesses the condition of the home and the property location to ensure that the home meets minimum property requirements (MPRs) pertaining to the safety, structural soundness, and sanitary conditions (e.g., space requirements, entry/exit, drainage, topography, HVAC systems, gas connection, roofing/crawl spaces, lead/radon, etc.).5

FHA inspection standards may be tougher to meet, especially for sellers who want to sell the home “as is.” For example, the FHA inspection guidelines require that the “heating unit is adequate and in good working condition,” the “water heater in good working condition,” that there are “working smoke detectors in the home,” and that the “sink in good working condition and with no leaks.” In fact, FHA standards sometimes even involve stipulations beyond the house itself (e.g. “If the home is in close proximity to an airport and its flight pattern, that may result in extreme noise hazards that could disqualify the home from being financed with an FHA loan.”).6

While inspection standards are important for ensuring that buyers are protected, they can create a disadvantage for prospective homebuyers in a highly competitive housing market. First-time homebuyers, buyers with less than excellent credit scores (FHA borrowers can have a credit score of as low as 580), and low-income and low-asset borrowers who are not able to afford a 20% down payment are mostly likely to get disadvantaged.

A home is the largest investment most people make in their lifetime. Buyers should be protected so that the price paid for the home is worth its value. Unfortunately, in a housing market where sales are moving swiftly, the time to undertake the inspection and appraisal is creating a hurdle for buyers obtaining FHA-insured loans who are typically first-time buyers and buyers obtaining VA-guaranteed loans.

1 The May 2021 survey was sent to 50,000 REALTORS® who were selected from NAR’s more than 1.4 million members through simple random sampling and to 5,876 respondents in the previous three surveys who provided their email addresses. There were 3,316 respondents to the online survey which ran from June 1-8, 2021; among these respondents, 1,653 had a client. NAR weights the responses by a factor that aligns the sample distribution of responses to the distribution of NAR membership.

2 The RCI Survey asks the respondent about the characteristics of their last transaction during the month. These transactions make up a random sample because the characteristic of the last transaction (e.g., whether the buyer obtained government or conventional financing) is random.

3 NAR started tracking single-family existing home sales since 1969 and total existing-home sales (single-family and condos/coops) since 1999. Single-family home sales make up 88% of existing-home sales in May 2021.

4 VA Appraisal Fees and Timeline Schedules, https://www.benefits.va.gov/HOMELOANS/appraiser_fee_schedule.asp(link is external)

5 Chapter 12, Minimum Property Requirement, https://benefits.va.gov/WARMS/docs/admin26/m26-07/Ch12_Minimum_Property_Requirement_NEW.pdf(link is external)

6 Ibid, https://fhalenders.com/fha-inspection/(link is external)

Scholastica (Gay) Cororaton

Research EconomistScholastica Gay Cororaton is the Research Economist for the National Association of REALTORS®.